Like any retail business, the success of health and wellness services depend on the right physical location. Brick-and-mortar presence impacts business success beyond revenue: from brand visibility to market leadership and competitive positioning that complements operations and marketing.

Let’s use fitness center openings in the Dallas metroplex as an example. Successful site evaluation boils down to two pillars: defining and sizing your market and competitors. Insights from this analysis help strike the right balance, capturing market demand while staying ahead of competitors.

Defining Your Geographical Market

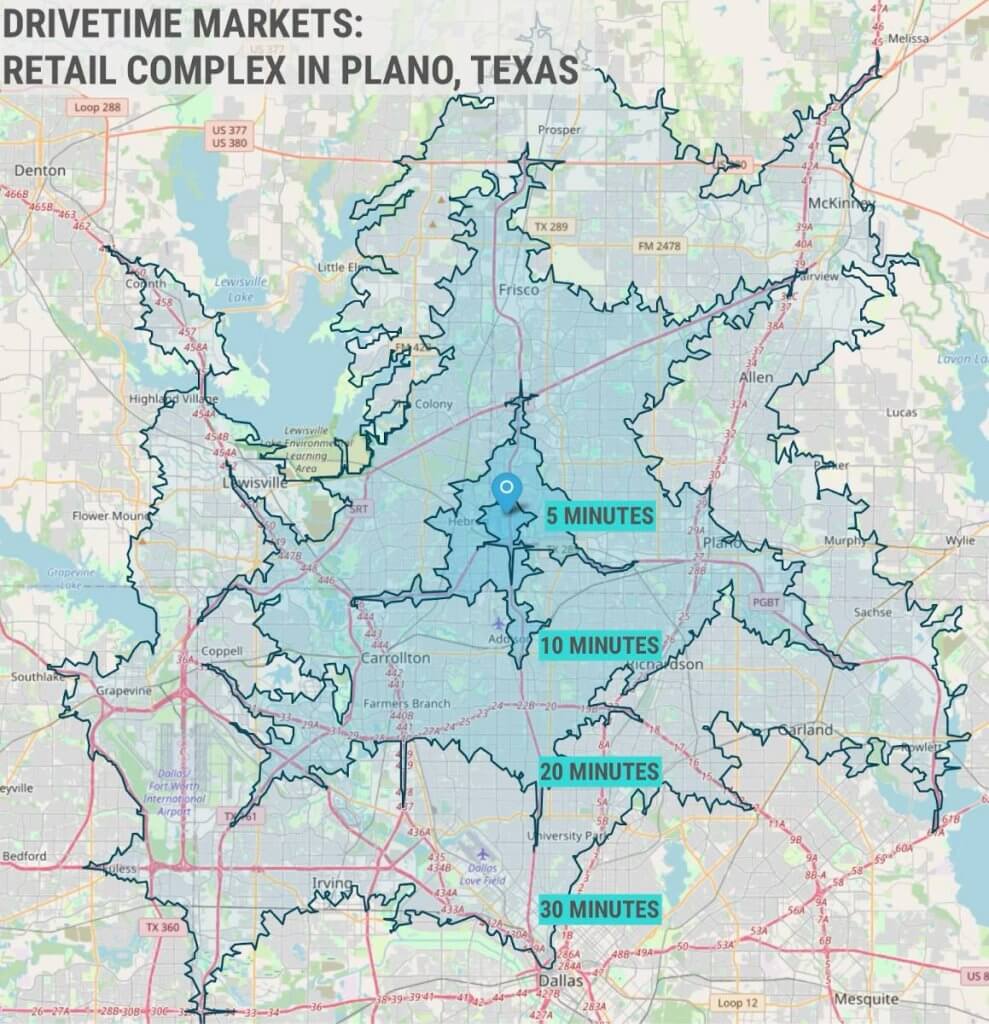

A market is defined by the geographical area around each location accessible to potential customers — for example, walking distance in dense urban areas or a reasonable drivetime in suburban areas. Below is an example of defining markets based on different drivetime coverages (5 to 30 minutes) for a retail complex in the city of Plano, a highly populated suburb of Dallas.

The ideal market coverage should be decided based on how likely customers would travel to the location for the service. For example, it would be unlikely that customers would drive more than 20 minutes to a fitness center.

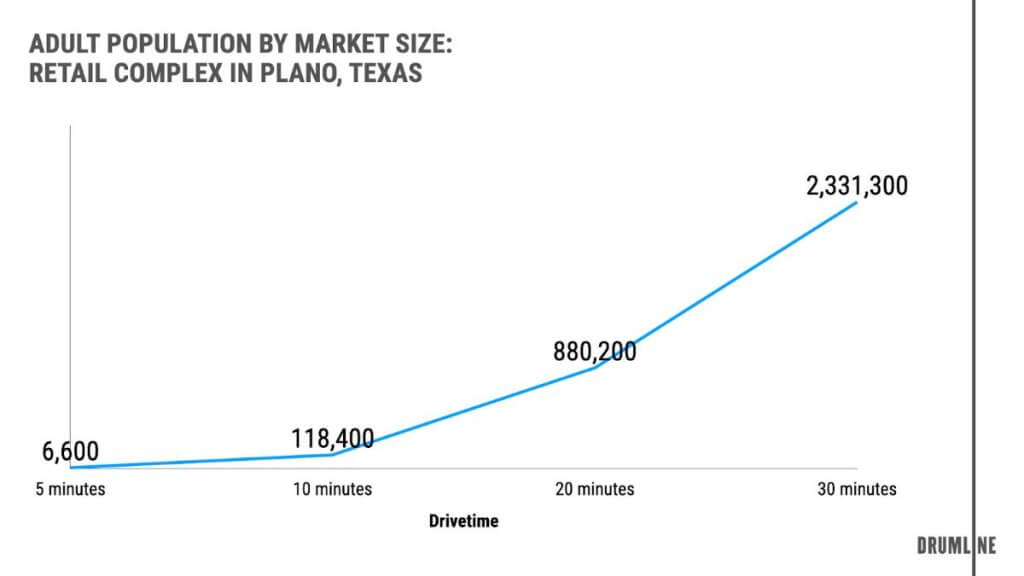

Once the market is defined, the market size (number of potential customers) can be calculated by overlaying Census or other demographic data (in case the target customer segment is more specific). Larger or denser markets indicate greater market size. Below depicts how the size of your market can vary based on the defined drivetime.

With each defined market, quantifying the market size allows decision makers to understand the viability of the market. From the chart, for example, if the decision makers have aligned that the 10-minute drivetime is the ideal market area, would a market covering 118,400 adults be enough to open a new location?

The market size also impacts operational decisions beyond the location of interest. The cost and effort to effectively penetrate the market will be higher for larger markets. It would require a higher marketing budget or additional locations within the market to maintain the level of brand awareness and presence to match the available market demand and competition.

Understanding Where Your Competitors Exist

Understanding existing competitor presence is equally important. Too few competitors may indicate that the market is underdeveloped or not viable, while too many guarantees steep competition. Proximity to the competitors becomes an added layer of consideration. Too many nearby means that customers have options and may easily defer to competitors, naturally risking market share and growth.

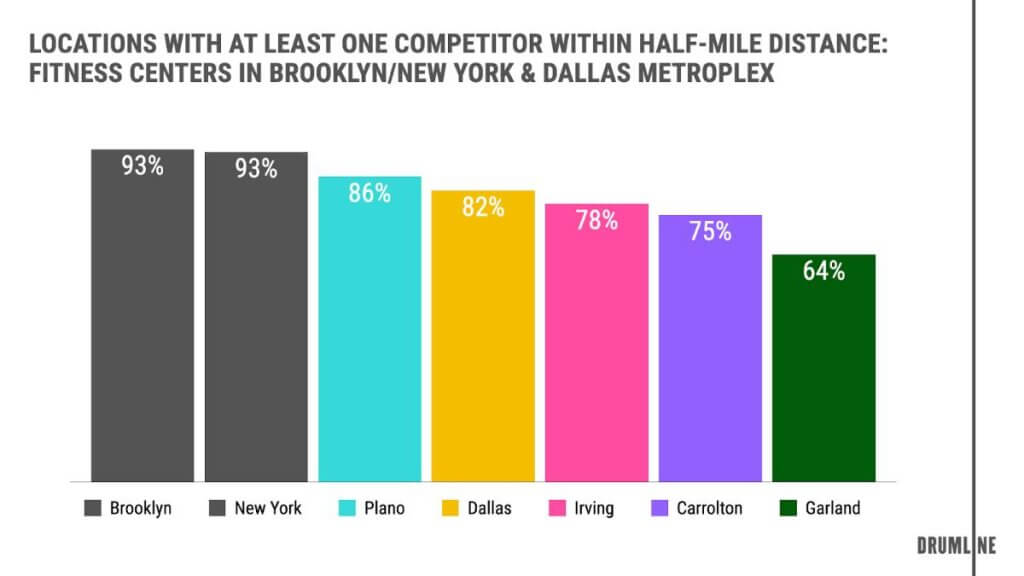

For example, we evaluate how many existing fitness centers are within a half-mile distance of each other. The chart below evaluates the Dallas metroplex and benchmarks against Brooklyn and New York City (one of the most densely populated markets in the US). Not surprisingly, nearly all fitness centers in Brooklyn and New York face at least one competitor within half a mile distance. Closely following is the city of Plano, which is (unlike the two metropolitan cities) a less concentrated but highly populated suburban area.

With exploding fitness demand and services, the proximity and concentration of competitors are most prevalent regardless of how densely populated the market is. Adding a layer of specialized services (e.g. gym vs. Pilates studio) can further narrow down the defined list of competitors for risk assessment.

Making Data-Driven Location Choices

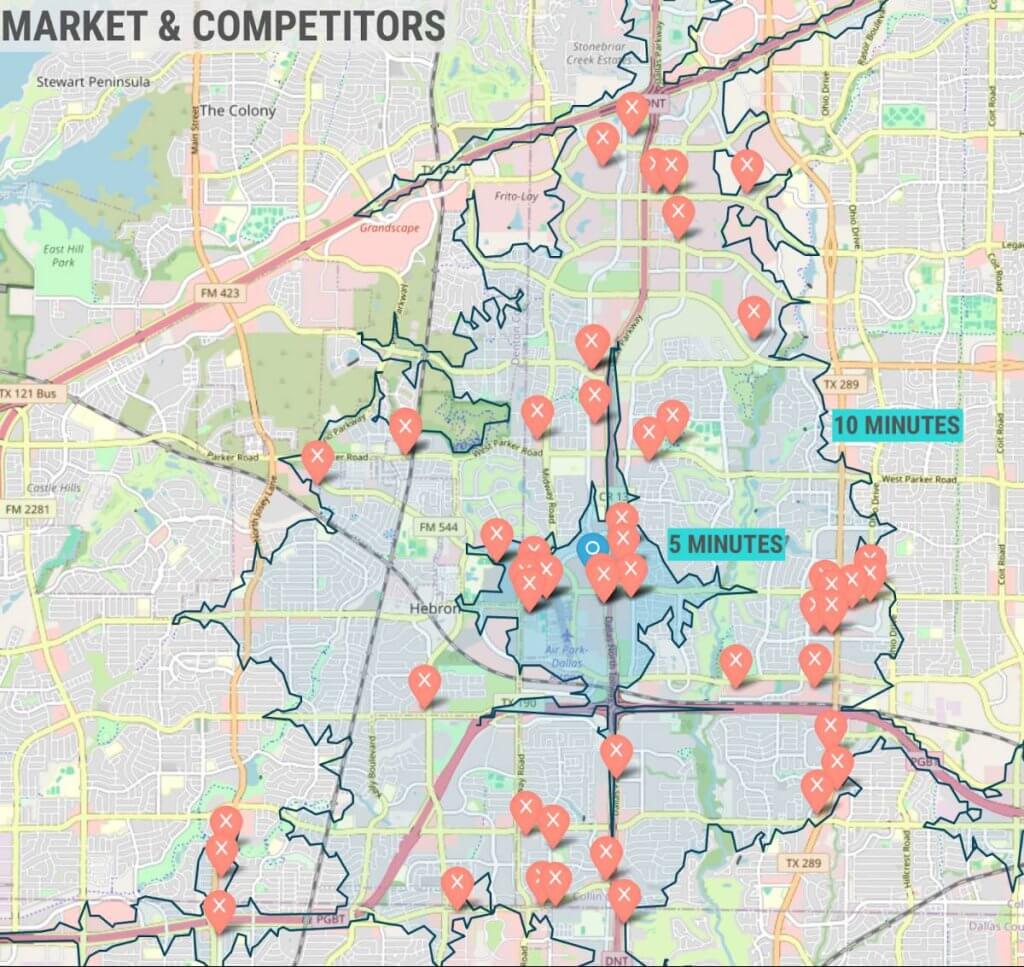

The information can be analyzed and visualized for insights and recommendations. For example, mapping the city of Plano below, we can examine different market areas (five- or ten-minute drivetime distance) and the potential competitors within each defined market in a single view.

Repeating the analysis, decision makers can identify markets with strong demand and lower risk, setting the stage for data-driven location decisions based on their business priorities and constraints (e.g. budget).

Harmonizing Your Business Goals with Location Data

Location decisions require quality geospatial data, in-depth market analyses, and grounded strategic decisions. By balancing market size and potential with competitor presence, businesses can uncover new market opportunities and make smarter choices about openings and closures. Our team is here to help turn these insights into actionable strategies that drive growth.